rhode island tax table 2019

How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table. This means that these brackets applied to all income earned in.

Solved I M Being Asked For Prior Year Rhode Island Tax And It Says Enter Your 2019 Rhode Island Tax What Does This Mean Is This Asking For My 2019 Refund

Find your income exemptions.

. Rhode Island Resident Credit for Tax Paid To Another State. Tax rate of 475 on taxable income between 68201 and. This form is for income earned in tax year 2021 with tax returns due in April 2022.

The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator. The guide features step-by-step instructions on how to file by mail or e-file your state.

3 rows Rhode Islands income tax brackets were last changed one year prior to 2019 for tax year. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Find your pretax deductions including 401K flexible account.

Finally we add 8809. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax. 3 The tax amount shown in the column TAX is 95000. The Rhode Island Department of Revenue is responsible for publishing the latest Rhode Island State Tax Tables each year as part of its duty to efficiently and effectively administer the.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Find your income exemptions. The Rhode Island tax booklet is a guide for state individuals on how to file their state income taxes.

How to Calculate 2018 Rhode Island State Income Tax by Using State Income Tax Table. The Rhode Island tax booklet is a guide for state individuals on how to file their state income taxes. The guide features step-by-step instructions on how to file by mail or e-file your state.

2 Find the 25300 - 25350 income line on this table. 4 Enter the 950 tax amount on RI-1040 or RI. Find your pretax deductions including 401K flexible account.

Employees must require employees submit state Form RI W-4 if hired in 2020 or. Multiply the amount of one withholding exemption 1000 annually for 2019 by the number of exemptions and allowances claimed by the employee note however that if the employee. The Rhode Island income tax rate for tax year 2020 is progressive from a low of 375 to a high of 599.

Rhode Island State Tax Tables 2021 Us Icalculator

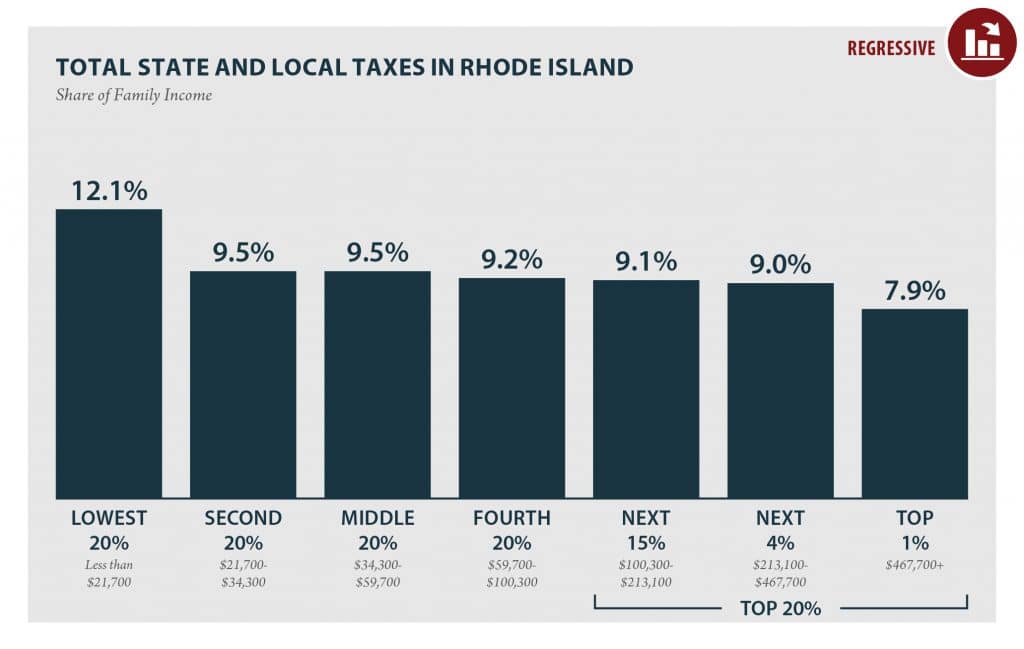

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

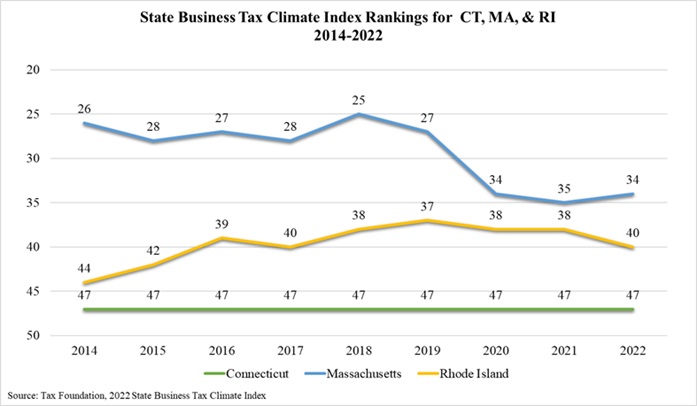

Rhode Island Ranks 37th In 2021 Business Tax Climate Index Rhode Island Public Expenditure Council

Lists Rhode Island Property Tax Rates

Ripec R I Backslid In Tax Rankings But 2022 Presents Opportunity For Reform

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Understanding Rhode Island S Motor Vehicle Tax

County Surcharge On General Excise And Use Tax Department Of Taxation

Ri Ri 1065 2019 2022 Fill Out Tax Template Online Us Legal Forms

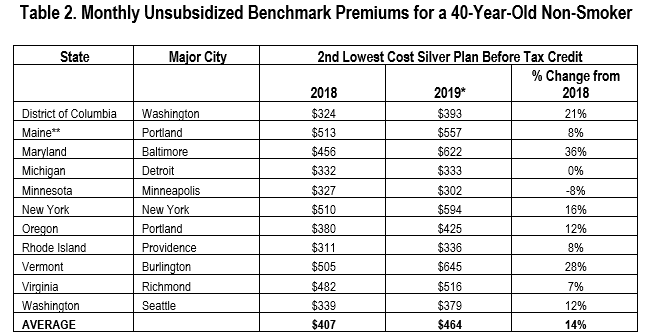

Rhode Island Preliminary Avg 2020 Aca Exchange Premium Changes Just 08 Thanks To Reinsurance Mandate Penalty Reinstatement Aca Signups

Map Of Rhode Island Property Tax Rates For All Towns

Insurance Premiums Increase As Insurers Request Hikes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Glocester Ri Official Town Web Site

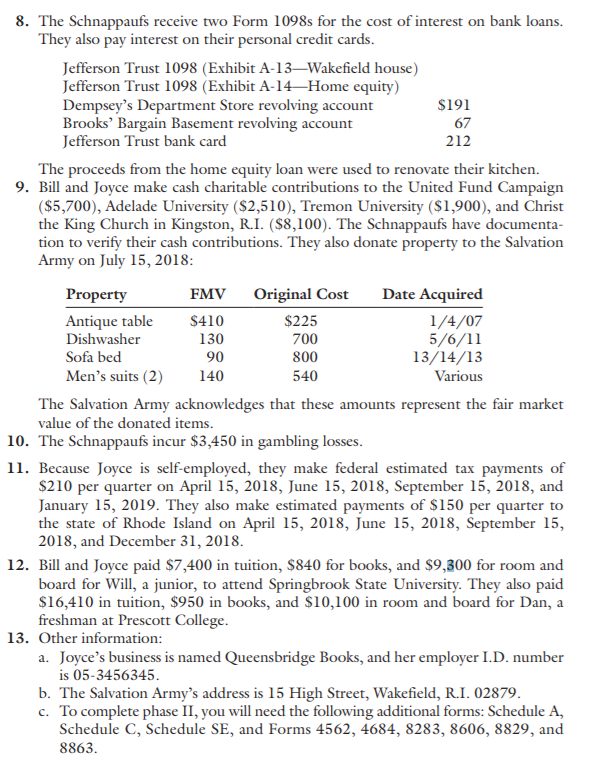

The Schnappauf Family In 2018 Bill And Joyce Chegg Com

Pennsylvania Tax Rate H R Block

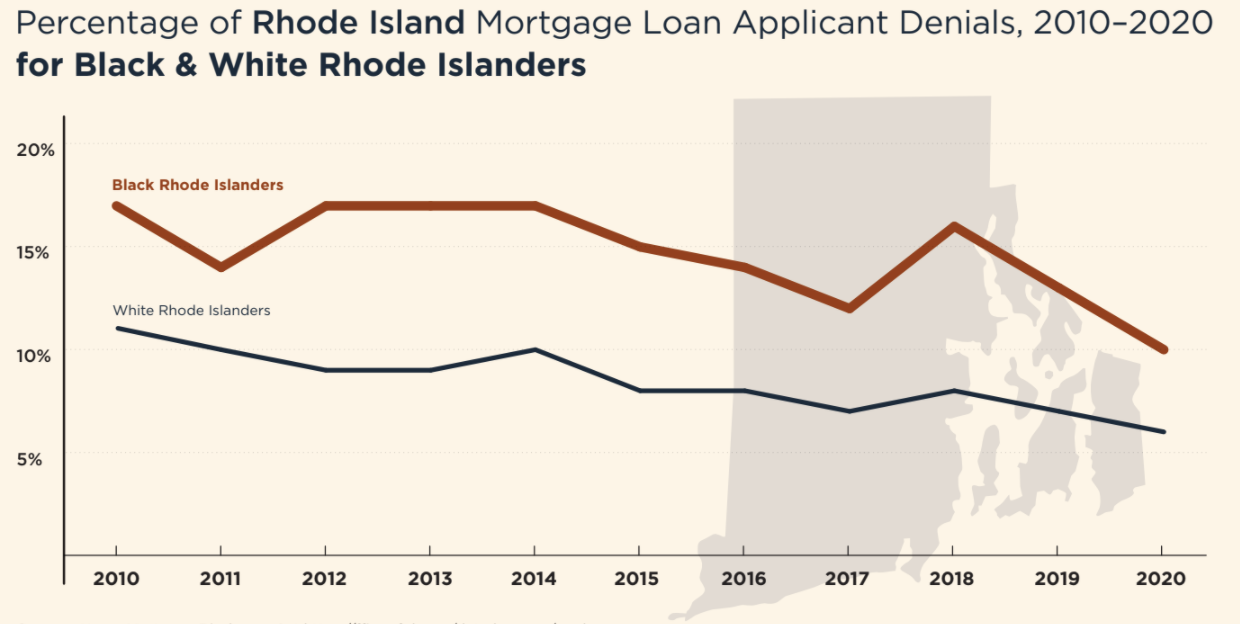

Redlining Never Really Went Away Black Rhode Islanders Still Face Racism When Buying A Home The Boston Globe

Best And Worst State Business Tax Environments 2021 The Tax Foundation